My main topic today is the uptrend in USD/JPY market. But first, just to point out how some of my previous calls are fairing. Gold is now breaking lower again and I still see it at $1000 in early 2014. Stock market indices are rallying strongly and I see no signs of topping formations here. So, these major trends in these two markets (gold and U.S. equities) that have been intact for entire 2013, are still under way.

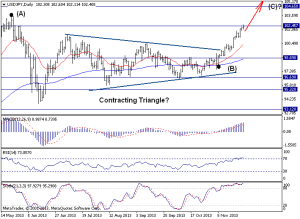

Now, let me say a few words about the USD/JPY market as this is one of the market where I have made big gains this year. After the huge rally to May 2013 top, the market spent several months (almost 6 months) trading sideways in a textbook Contracting Triangle. And a couple of weeks ago it broke higher. So I have strong reasons to believe that larger-degree uptrend from Sept 2012 low has resumed. If correct, gains twd the 108.21 Fibonacci level are likely in the 1st quarter of 2014. Only a move below 100.00 will negate this bullish outlook.

Here’s the chart from this week’s Short-Term update (reserved for subscribers only) with my wave labelling:

If you’d like to regularly get my weekly and daily analysis for major forex pairs as well as the U.S. stock indices, please take a look at the following page and see if one of the subscription plans may work for you.

http://trendrecognition.com/subscription

Trade with the Trend!

Alexander

http://www.Trendrecognition.com

Disclaimer: The services provided by Trend Recognition Ltd are intended for informational and educational purposes only. At no time will Trend Recognition make specific recommendations for any specific person, and at no time may a reader, caller or viewer be justified in inferring that any such advice is intended. The service is not a recommendation to buy or sell securities or an offer to buy or sell securities. The publishers of Trend Recognition website are not brokers or registered investment advisors and are not acting in any way to influence the purchase or sale of any security and/or its derivatives. You should not rely solely on the information provided on this site in trading.